what is the sales tax in wyoming

At 4 the states sales tax is one of the lowest of any state with a sales tax though counties can charge an additional rate of up to 2. The taxability of various transactions like services and shipping can vary from state to state as do policies on subjects such as whether excise taxes.

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

The state sales tax rate in.

. What is the sales tax in Wyoming 2021. Local tax rates in Wyoming range from 0 to 2 making the sales tax range in Wyoming 4 to 6. Since books are taxable in the state of Wyoming Mary.

The Excise Division is comprised of two functional sections. This is the total of state county and city sales tax rates. Wyoming Sales Tax Guide.

The minimum combined 2022 sales tax rate for Cheyenne Wyoming is 6. What purchases are taxable in Wyoming. Lowest sales tax 4 Highest sales.

Maximum Possible Sales Tax. You can calculate the sales tax in Wyoming by multiplying the final purchase price by 04. WY State Sales Tax Rate.

Mary owns and manages a bookstore in Cheyenne Wyoming. Sales Tax Handbook Wyoming has state sales tax of 4 and allows local governments to collect a local option sales tax of up. Cities counties and other municipalities may also have additional.

Municipal governments in Wyoming are also allowed to collect a local-option sales tax that ranges from 0 to 2 across the state with an average local tax of 1436 for a total of. Wyoming has no state income tax. Is there state sales tax in Wyoming.

Wyoming has state sales tax of 4 and allows local governments to collect a local option. Find your Wyoming combined state and. So if you are going.

The state also has several special local and excise taxes. The minimum combined 2022 sales tax rate for Sheridan Wyoming is. And if we talk about the sales tax in Wyoming it is the destination-based sales tax state.

WY Combined State Local Sales Tax Rate avg 5392. What is Wyoming sales tax rate 2020. We strongly recommend using a sales tax calculator to determine the exact sales tax amount for.

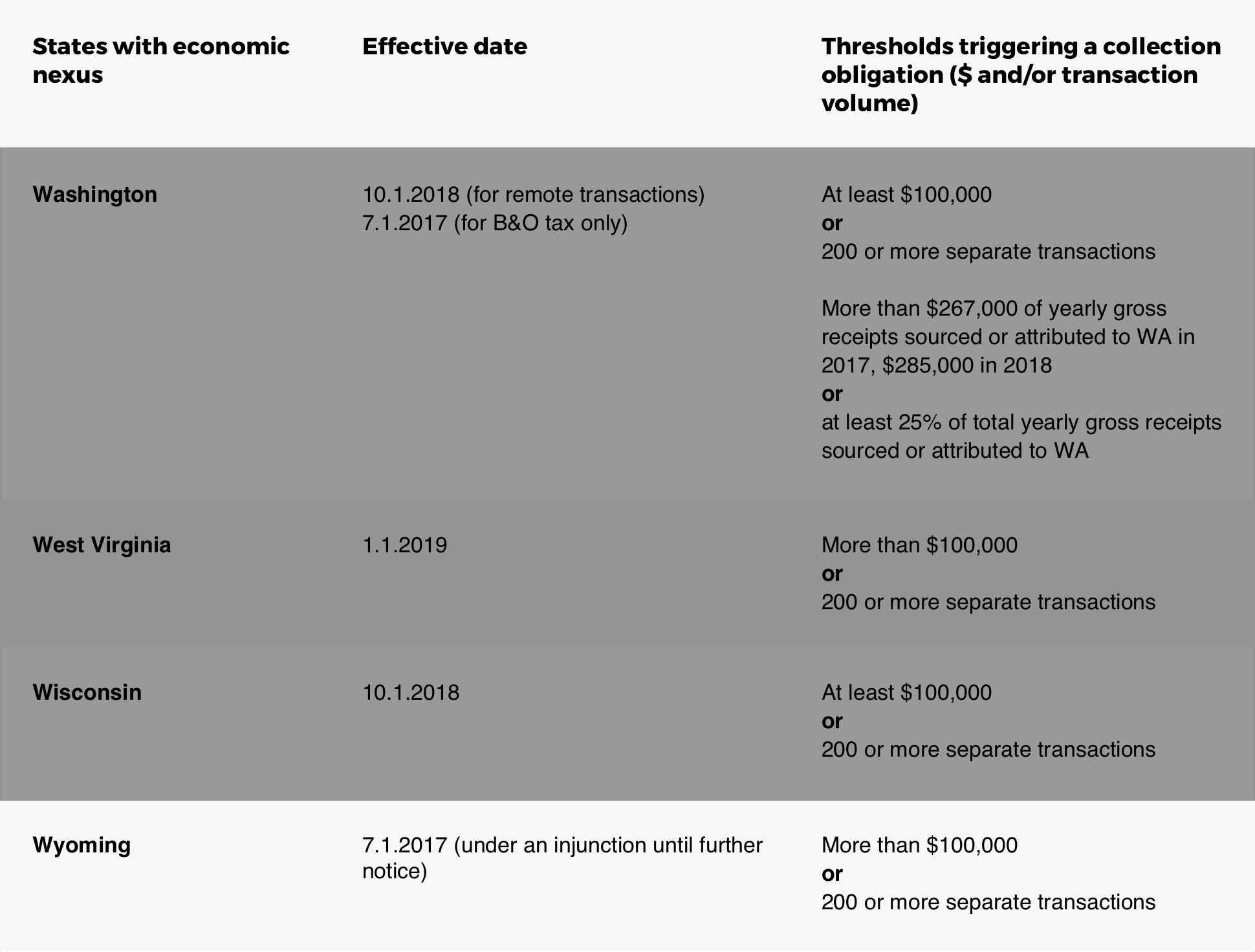

31 rows Wyoming WY Sales Tax Rates by City. 2021 List of Wyoming Local Sales Tax Rates. State wide sales tax is 4.

In addition Local and optional taxes can be assessed. Wyoming has state sales tax of 4 and allows local governments to collect a local option. For example lets say that you want to purchase a new car for 30000 you would use.

Wyomings sales tax is 4 percent. Heres an example of what this scenario looks like. The state-wide sales tax in.

Wyoming State Sales Tax. Wyoming first adopted a general state sales tax in 1935 and since that time the rate has risen to 4. Average Local State Sales Tax.

13 hours agoIt is added to the 3 lodging tax imposed by the Wyoming Office of Tourism and the 2 rebated by Albany County resulting in an overall 7 sales tax rate on lodging. What is the sales tax rate in Sheridan Wyoming. Wyoming is the best place to live when it comes to taxes.

181 rows 2022 List of Wyoming Local Sales Tax Rates. The base state sales tax rate in Wyoming is 4. Wyoming Use Tax and You.

Tax rates can vary based on the location of your business and the location of your customer plus the levels of sales tax that apply in those specific locations. Maximum Local Sales Tax. The Wyoming sales tax rate is currently 4.

On top of the state sales tax there may be one or more local sales taxes as well as one or. This is the total of state county and city sales tax rates.

Wyoming Taxes Wy State Income Tax Calculator Community Tax

Historical Wyoming Tax Policy Information Ballotpedia

.png)

How To Get A Sales Tax Permit In Wyoming International Founders Guide Doola Blog Doola Blog

Map Of Wyoming Showing The Change In Taxable Sales By County Sweetwaternow

Wyoming Certificate Of Authority Foreign Wyoming Corporation

Amazon To Begin Collecting Sales Tax In Wyoming Local News Wyomingnews Com

Wyo Property Tax Rates Rank Right At The Bottom

Where Wyoming S State And Local Revenue Comes From Wyoming Liberty Group Wyoming Liberty Group

New Wyoming Online Sales Tax Rules

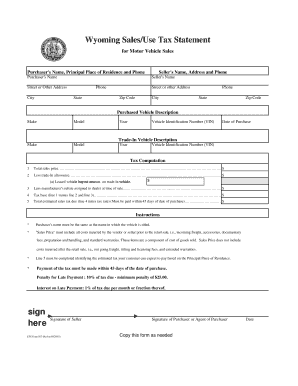

Form 107 Fillable Wy Sales Use Tax Statement For Motor Vehicle Sales

Iowa Idaho Indiana Minnesota North Dakota Nebraska Nevada Oklahoma And Wyoming Go Live On The Runsignup Sales Tax System Runsignup Blog

Sales Tax Nexus 5 Signs Your Company May Owe Taxes In Other States Stage 1 Financial

How To File And Pay Sales Tax In Wyoming Taxvalet

How To File And Pay Sales Tax In Wyoming Taxvalet

Stats And Facts About Wyoming Its 132nd Anniversary And More

Fillable Online Wyoming Sales Use Tax Statement Fax Email Print Pdffiller

State Government Tax Collections General Sales And Gross Receipts Taxes In Wyoming 2022 Data 2023 Forecast 1942 2021 Historical